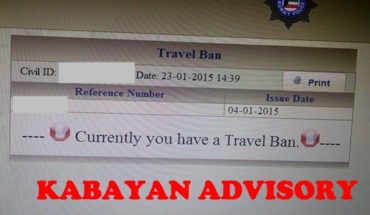

The rise in mobile phone and gold-cashing schemes, as well as a lack in control over these activities has led to an increased number of travel bans, both for Kuwaitis and expats. The Justice Ministry’s annual statistics revealed that in 2023, the total number arrests and travel bans reached 153.784, which is about 13,779 more than the 140,005 total from the previous year. The statistics showed that in 2023, the number of decisions relating to mobile phone installment plans resulting in travel bans reached 73.612, while the number for lifting travel bans totaled 46.959.

This phenomenon, which has become more prevalent in recent years is due to people’s desire to get cash to pay their financial obligations. They buy certain items on installment and then sell them to stores to receive cash, but for a lower price than they paid. They are then faced with a high bill due to the interest rate, and many face legal issues because they have not paid. Mohammad Ramadan, an economic expert, confirmed that many people have been victims of these operations. He emphasized the need for the Ministry of Commerce and Industry (MCI) to conduct public education programs on this issue so that people don’t fall victim to unscrupulous practices.

He called for the amending of the relevant laws if these operations were not criminalized, especially because they could lead to a rise in the number travel ban decisions. Faisal al-Harbi, an economist and media professional, revealed that the above operations are chaotic and random. They destroy the economy and send some people to jail.

He warned against the practice of selling mobile phones to get cash, because one might be forced to do so by circumstances or be deceived, only to find out later that he has to pay KD1,000 in total. He questioned the role of the Ministry of Commerce and Industry, saying that the ministry allowed citizens and expatriates be victims of such operations.

He said that gold mortgage operations are included in the manipulation of such operations. He said that the owner of the shop receives 10 percent interest each month, which prevents citizens and expatriates to travel due to the accumulation. He called for a tighter control of small mobile phone companies, which are common in complexes. They deceive people. He called on anyone who posts an advertisement about these operations on social media or other platforms to be held accountable.

Saad Ibrahim revealed in a related event that he had a deal with a mobile shop that bought a phone from his company. He received KD250 in cash from the shop, on condition that he pay KD35 per month for two years. This meant he had to pay KD840. He was unable pay after five months because he lost a job. The company hired a law firm to help him settle the debt. Hossam Mandour said that a mobile company bought his phone and offered him KD300 in cash if he paid KD30 a month for a year. He was surprised to learn that the payment period was actually two years. When he stopped paying he was prohibited from traveling.