Frequently Asked Questions (FAQ) About Termination Indemnity

Termination of Services and Employees or Benefits after End of Services has been a constant topic of discussion over the years. Lots of doubts hover around the benefits you get on termination indemnity and these doubts are mostly left unanswered or foreign workers simply leave the country without getting their right benefits. This time, we are going to clear out the top 3 questions that are mostly heard when it comes to termination indemnity.

Frequently Asked Questions About Termination Indemnity

“Am I eligible of claiming termination indemnity even if I am a foreign national?”

According to the Labor Law in Kuwait, any employee that works in the private sector, regardless of nationality, is eligible to claim the termination indemnity. However, there are several organizations that intend not to pay their employees by giving false statements that are not mentioned in the law.

Another reason commonly used by employers so they can pass from paying termination indemnity is the contributions they made for their employees on the Social Security Funds. This is actually a false statement because the payment of the Social Security fund is paid by both the employer and the employee. There is a particular fixed percentage that both parties need to pay.

But there are other employers that decide to pay the full amount of the Social Security and through the agreement from the Kuwait Nationals, they will deduct the amount of employee’s share of payment from their termination indemnity. This method is considered illegal because organizations cannot bargain with employees in this manner. They should supposedly share the fixed percentage of the Social Security Fund and also pay the employee their termination indemnity.

“Am I eligible for termination indemnity if I terminate my contract?”

With regards to the eligibility for termination indemnity, the most important factor to consider is the contract type. If you are under a fixed contract and you decide to leave your company within 3 years, you will have to pay the company and the payment can either be an adjustment to the full and final settlement or an adjustment from your termination indemnity can be made.

But if you continue your employment for 3 years, the employer will be eligible to pay you the full termination indemnity. Any employee who cannot complete their 3-year contract cannot receive the termination indemnity.

“How can I compute my termination indemnity?”

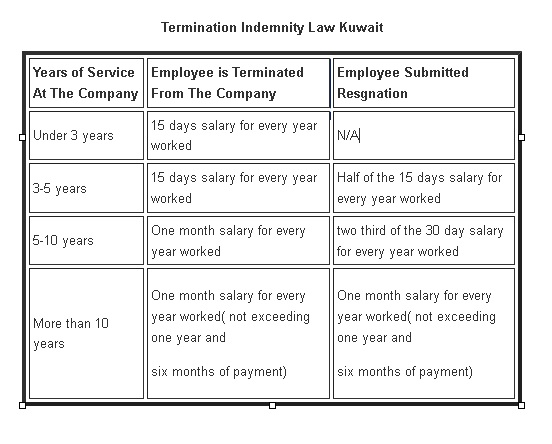

There are several ways to compute your termination indemnity. The table below will guide you.

Source | Kuwait Local