The parliamentary Financial and Economic Affairs Committee has approved four bills on imposing a tax on remittances of expatriates, taking into account those with low income.

On the reports of Arabtimesonline Committee Chairman MP Salah Khorshid said the majority of the panel members approved the bills, indicating they have taken into consideration the possibility of imposing a lower tax on those with limited income.

He affirmed the opinions of the committee’s advisors, legal experts and constitutional expert Abdel Fattah Hassan were considered in approving these bills to ensure that the Constitution is not violated. He revealed the government has reservations over the proposals, especially the mechanism for imposing tax.

He said the government wants to impose tax on citizens and expatriates, but the committee insisted that tax will be imposed only on remittances of expatriates and the revenue will be about KD 70 million for remittances estimated at KD 19 billion per year.

He went on to say that Saudi Arabia, the United Arab Emirates (UAE) and Bahrain are currently applying this law. He argued that banks and exchange companies are collecting fees for remittances, so he wonders why the government is not taking a similar step in the interest of the State.

He stressed the need to remove obstacles and monitor the implementation of the bills, once approved, under the supervision of the Central Bank of Kuwait (CBK) and Ministry of Finance. He added the bills stipulate punishment in case of failure to comply and the executive authority shall play a role in this regard. He cited the practice in other countries where fees and up to 30 percent tax are collected from expatriates who, he pointed out, are satisfied with the fees and taxes provided they are given residency.

Commenting on the proposal, Rapporteur of the committee MP Saleh Ashour confirmed that they discussed the bills with legal experts and advisers of the panel to avoid constitutional violations.

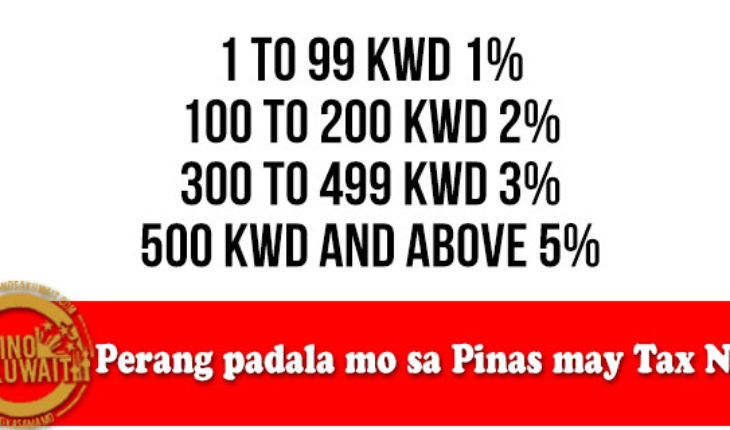

According to the bills,

one percent tax will be imposed on remittances ranging from KD 1 to KD 99,

two percent for KD 100 to KD 200,

three percent for KD 300 to KD 499 and five percent for KD 500 and above.

Penalties include fine of not more than KD 10,000

whether individual or company; imprisonment of not more than five years and fine equal to twice the amount of remittance if the money is transferred through a channel other than the approved exchange companies and banks, Ashour clarified.

What can you say about this?